Women-Specific LIC Policies: Empowering Women Financially

Introduction

In today’s rapidly evolving financial landscape, it’s crucial for women to take control of their financial future. Life Insurance Corporation of India (LIC) offers a range of policies specifically designed to meet the unique needs of women. These policies not only provide financial security but also empower women to achieve their financial goals. In this blog, we will explore the various LIC policies tailored for women and how they can benefit from them.

Why Women-Specific Policies?

Women often face different financial challenges compared to men, such as career breaks for childbirth, longer life expectancy, and health issues specific to women. Women-specific LIC policies address these challenges by offering customized benefits and features.

Key LIC Policies for Women

- LIC Jeevan Bharati-I Plan

- Features: This is a money-back policy specially designed for women. It offers survival benefits at regular intervals, making it a great option for women looking for periodic returns.

- Benefits: It includes an in-built Critical Illness Benefit Rider, which covers female-specific illnesses like breast cancer and cervical cancer.

- LIC Aadhaar Shila Plan

- Features: Exclusively for women, this plan combines savings and protection. It provides a lump sum amount at maturity and financial protection against death during the policy term.

- Benefits: The plan also includes loyalty additions, enhancing the overall benefits for the policyholder.

- LIC’s Cancer Cover

- Features: This is a health insurance policy specifically designed to cover cancer treatment expenses. Women are more prone to certain types of cancer, making this an essential policy.

- Benefits: It offers a lump sum benefit on the diagnosis of early or major stage cancer, ensuring that the policyholder can focus on recovery without financial worries.

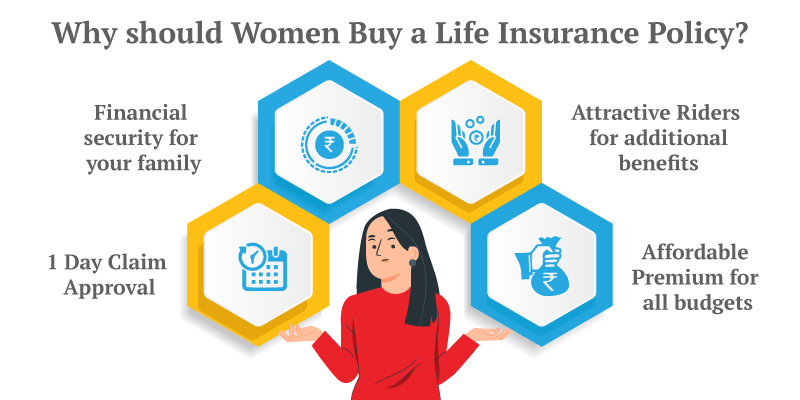

Advantages of Women-Specific LIC Policies

- Tailored Benefits: These policies are designed keeping in mind the specific financial needs and challenges faced by women.

- Comprehensive Coverage: From health issues to financial security, these policies offer comprehensive coverage, ensuring peace of mind.

- Financial Independence: By investing in these policies, women can secure their financial future and gain independence.

How to Choose the Right Policy?

Selecting the right policy depends on individual financial goals and needs. Here are some tips to help you choose:

- Assess Your Needs: Evaluate your financial goals, health concerns, and future plans.

- Compare Policies: Look at the features, benefits, and premiums of different women-specific policies.

- Consult an Expert: Seek advice from a LIC agent to understand the best options available.

Conclusion

Empowering women financially is crucial for their personal and professional growth. LIC’s women-specific policies are designed to provide the necessary financial security and support. By investing in these policies, women can ensure a secure and prosperous future. For more information and to explore these policies, visit licfuture.com today. Contact 7231814845