Saral Jeevan Bima Plan (859)

The Saral Jeevan Bima Plan (859) is a standard term life insurance policy offered by the Life Insurance Corporation of India (LIC). Here are the key details about the plan:

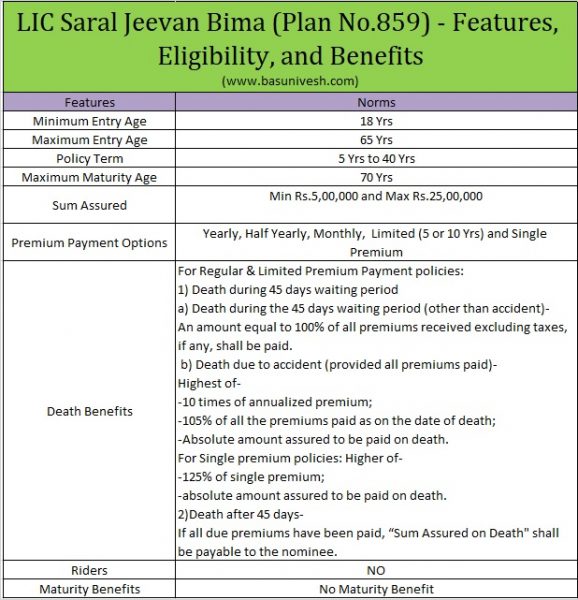

Key Features

- Eligibility:

- Minimum Age: 18 years

- Maximum Age: 65 years

- Policy Term:

- Minimum Term: 5 years

- Maximum Term: 40 years

- Sum Assured:

- Minimum Sum Assured: ₹5,00,000

- Maximum Sum Assured: ₹25,00,000

- Premium Payment:

- Modes: Yearly, Half-yearly, Quarterly, and Monthly

- Premium Payment Term: Regular premium, limited premium payment (5 or 10 years), or single premium

- Benefits:

- Death Benefit: In case of death of the policyholder during the policy term, the nominee will receive the sum assured.

- Maturity Benefit: No maturity benefit is provided under this plan as it is a pure term insurance policy.

- Waiting Period:

- Initial Waiting Period: 45 days from the date of commencement of risk. During this period, no death benefit is payable except for death due to an accident.

- Rider Options:

- No rider options are available with this plan.

Premium Rates

Premium rates depend on the age, sum assured, policy term, and premium payment mode chosen by the policyholder.

Exclusions

- Suicide Clause: If the policyholder commits suicide within 12 months from the date of commencement of risk, 80% of the premiums paid (excluding taxes, extra premium, and rider premiums) will be returned to the nominee.

Other Features

- Grace Period: A grace period of 30 days for yearly, half-yearly, and quarterly premiums, and 15 days for monthly premiums, is provided for payment of due premiums.

- Revival: The policy can be revived within 5 years from the date of the first unpaid premium by paying all due premiums along with interest.

Tax Benefits

- Premiums paid under this plan are eligible for tax benefits under Section 80C of the Income Tax Act, 1961.

- The death benefit received by the nominee is also tax-free under Section 10(10D) of the Income Tax Act, 1961.

This plan is designed to provide financial security to the policyholder’s family in case of their untimely death. It’s a straightforward, no-frills term insurance policy aimed at ensuring coverage without the complexities of additional benefits or riders.

For more specific details or to apply for the LIC Jeevan Kiran Plan, you can visit the official LIC website or contact your LIC agent 7231814845.