Plan Jeevan Anand (915)

Jeevan Anand Plan No. 915 is a popular endowment plan offered by Life Insurance Corporation of India (LIC). It combines the benefits of both endowment and whole life plans, providing financial protection against death throughout the lifetime of the policyholder, with the provision of lump sum payment at the end of the selected policy term in case of survival.

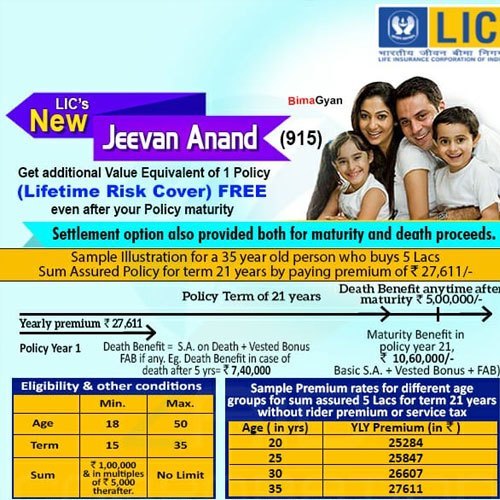

Key Features and Benefits of Jeevan Anand (Plan No. 915)

- Maturity Benefit:

- On survival to the end of the policy term, the basic sum assured along with vested Simple Reversionary Bonuses and Final Additional Bonus (if any) will be paid to the policyholder.

- Death Benefit:

- During the Policy Term: On death during the policy term, the death benefit, defined as the sum of the “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional Bonus (if any), shall be payable. The sum assured on death is higher of:

- 125% of the Basic Sum Assured; or

- 7 times of annualized premium

- This death benefit shall not be less than 105% of all the premiums paid as on date of death.

- After the Policy Term: Basic Sum Assured is paid to the nominee, i.e., the life cover continues till death of the policyholder.

- During the Policy Term: On death during the policy term, the death benefit, defined as the sum of the “Sum Assured on Death” and vested Simple Reversionary Bonuses and Final Additional Bonus (if any), shall be payable. The sum assured on death is higher of:

- Participation in Profits:

- The policy participates in the corporation’s profit and is eligible for Simple Reversionary Bonuses declared per annum.

- Optional Riders:

- Accidental Death and Disability Benefit Rider

- New Term Assurance Rider

- New Critical Illness Benefit Rider

- Policy Term and Premium Payment Term:

- Policy Term: 15 to 35 years

- Premium Payment Term: Equal to the Policy Term

- Premium Payment Modes:

- Yearly, Half-Yearly, Quarterly, and Monthly (ECS)

- Loan Facility:

- Loan can be availed against the policy.

- Surrender Value:

- The policy can be surrendered at any time during the policy term provided premiums have been paid for at least three full years.

- Grace Period:

- A grace period of one month but not less than 30 days will be allowed for payment of yearly, half-yearly, or quarterly premiums and 15 days for monthly premiums.

- Revival:

- If the policy has lapsed, it can be revived within a period of 2 consecutive years from the date of the first unpaid premium.

- Free Look Period:

- If the policyholder is not satisfied with the terms and conditions of the policy, they may return the policy to the corporation within 15 days from the date of receipt of the policy document.

Eligibility Criteria

- Minimum Age at Entry: 18 years

- Maximum Age at Entry: 50 years

- Maximum Age at Maturity: 75 years

- Minimum Basic Sum Assured: ₹1,00,000

Example

Consider a person aged 30 years, choosing a policy term of 25 years with a Basic Sum Assured of ₹10,00,000. The person would pay premiums for 25 years. If the person survives the policy term, they receive the sum assured plus bonuses. If the person passes away during the policy term, their nominee receives the death benefit. After the policy term, the risk cover continues, and the Basic Sum Assured is paid to the nominee upon the policyholder’s death.

For detailed illustrations and premium calculations based on individual requirements, it’s advisable to contact me 7231814845. I am a LIC Agent.