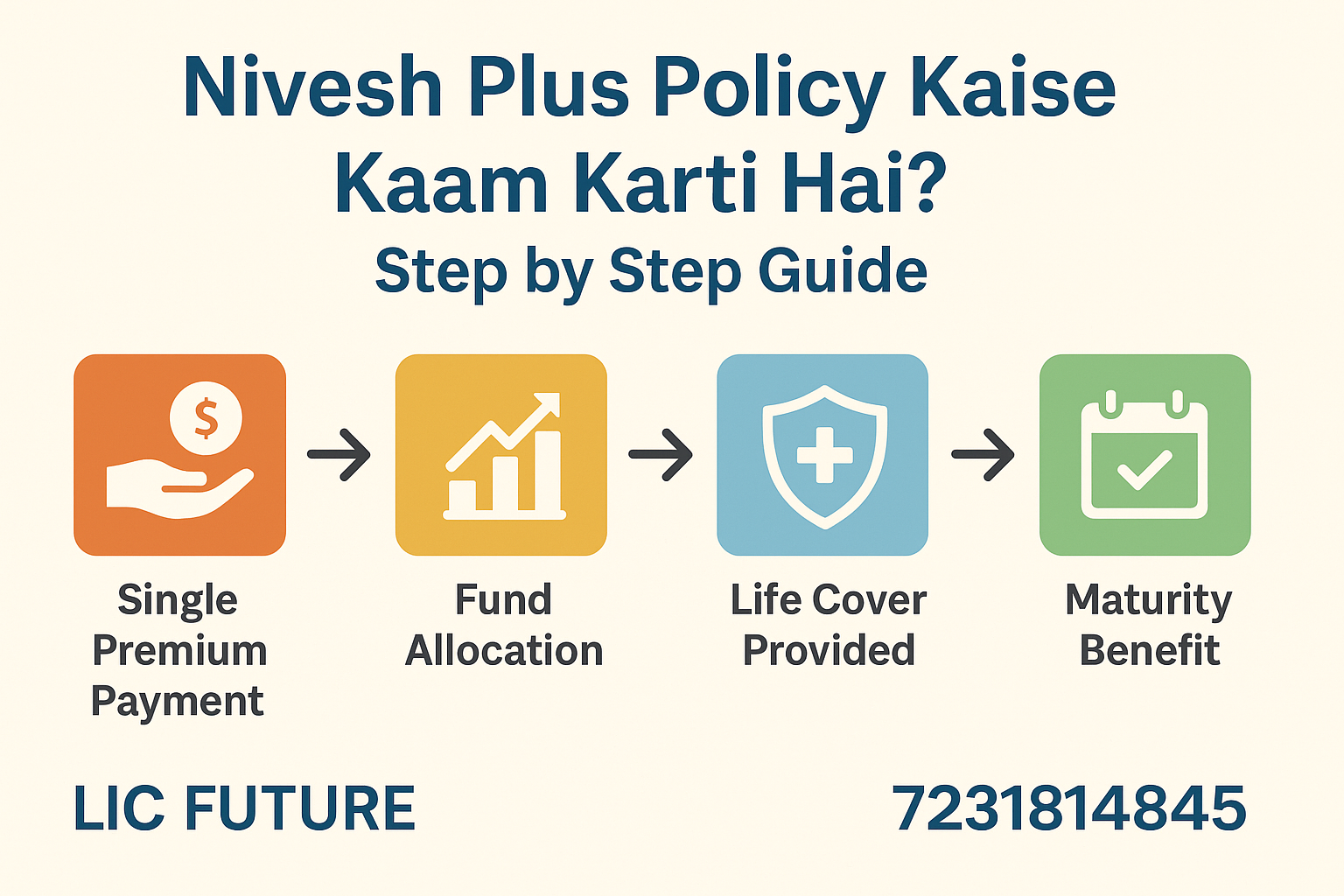

Nivesh Plus Policy Kaise Kaam Karti Hai? Step by Step Guide (2025)

LIC ki Nivesh Plus Policy ek Unit Linked Insurance Plan (ULIP) hai jo beema aur nivesh dono ka fayda ek saath deti hai. Agar aap soch rahe hain ki yeh policy kaise kaam karti hai, toh is blog mein hum iske har pehlu ko step by step samjhayenge. Yeh blog khas taur par un logon ke liye hai jo financial security aur long-term investment dono chahte hain. Website LIC Future ki taraf se yeh ek comprehensive aur valuable guide hai, jise aap apne faislon mein madad ke liye use kar sakte hain.

Step 1: Samajhiye LIC Nivesh Plus Kya Hai?

LIC Nivesh Plus ek single premium, non-participating, unit-linked life insurance plan hai. Iska matlab hai ki aap ek baar premium dete hain aur aapko life cover ke saath ek investment opportunity bhi milti hai.

Key Features:

- Single Premium Plan

- Unit Linked Insurance Product (ULIP)

- Life Insurance + Investment Combo

- Market-linked returns

- Fund switching option

- Tax benefits under 80C and 10(10D)

Step 2: Eligibility Criteria Kya Hai?

| Criteria | Details |

|---|---|

| Minimum Entry Age | 90 days |

| Maximum Entry Age | 70 years |

| Minimum Maturity Age | 18 years |

| Maximum Maturity Age | 85 years |

| Policy Term | 10 to 25 years |

| Minimum Premium | Rs. 1,00,000 (Single Premium) |

| Maximum Premium | No Limit |

Aapka eligibility status in criteria ke adhar par decide hota hai.

Step 3: Premium Kaise Kaam Karta Hai?

Is policy mein aapko ek hi baar premium dena hota hai. Yeh premium aapke chuney gaye fund mein invest kiya jata hai. LIC Nivesh Plus mein aapke paas 4 alag-alag fund options hote hain:

- Bond Fund – Low risk

- Secured Fund – Moderate risk

- Balanced Fund – Balanced risk

- Growth Fund – High risk, high return

Aap apne financial goals ke hisaab se fund choose kar sakte hain.

LIC Future Tip:

Agar aap risk lene ke liye tayar hain aur aapka horizon long-term ka hai, toh Growth Fund best ho sakta hai.

Step 4: Fund Switching Facility

Niveshak apne investment ko ek fund se doosre fund mein switch kar sakta hai. LIC har policyholder ko har policy year mein 4 free fund switches provide karta hai. Uske baad nominal charge lagta hai.

Yeh feature investors ko flexibility deta hai market ke hisaab se apne portfolio ko adjust karne ki.

Step 5: Death Benefit & Maturity Benefit

Death Benefit:

- Death hone par nominee ko milta hai: Higher of Fund Value or Sum Assured

- Death during first 5 years: Fund Value + Mortality Charges Waved

Maturity Benefit:

- Policy term complete hone par Fund Value aapko milti hai.

- Fund Value ka calculation market performance par depend karta hai.

Loyalty Additions:

Currently, Nivesh Plus mein koi loyalty addition ya bonus nahi hota kyunki yeh non-participating ULIP plan hai.

Step 6: Partial Withdrawal Facility

LIC Nivesh Plus mein 5 policy years ke baad aap partial withdrawal kar sakte hain:

- Minimum withdrawal: Rs. 5,000

- Maximum: Fund Value ka kuch percentage (LIC ke terms ke hisaab se)

Yeh feature emergencies ke waqt kaafi kaam aata hai.

Step 7: Policy Charges

Policy ke saath kuch charges bhi judey hote hain:

- Premium Allocation Charges

- Policy Administration Charges

- Fund Management Charges

- Mortality Charges

- Switching Charges (after 4 free switches)

In charges ka effect fund value par padta hai, isliye charges ko dhyan se samajhna zaroori hai.

Step 8: Tax Benefits

LIC Nivesh Plus Policy ke through aapko Income Tax Act ke section 80C ke tahat premium par chhoot milti hai. Saath hi, maturity amount bhi section 10(10D) ke under tax-free ho sakti hai (certain conditions ke under).

LIC Future Reminder:

Tax benefits government policies ke adhar par change ho sakte hain. Hamesha latest updates ke liye apne tax advisor se consult karein.

Step 9: Investment Strategy & Returns

ULIP plan hone ke karan, Nivesh Plus ka return market par depend karta hai. Aapko apni risk appetite aur market trend ke hisaab se fund select karna chahiye.

Historic Performance:

- Growth Fund – High Volatility, High Return

- Bond Fund – Stable but Low Return

Returns ki koi guaranteed value nahi hoti.

Step 10: How to Buy LIC Nivesh Plus?

Yeh policy aap kharid sakte hain:

- Offline – LIC Agent ke through (jaise ki Abhishek Singhal, LIC Future se)

- Online – LIC ki official website se

Required Documents:

- Identity proof

- Address proof

- PAN card

- Photograph

- Age proof (birth certificate, etc.)

Step 11: Who Should Buy LIC Nivesh Plus?

LIC Future ke experts ke mutabiq, yeh policy unke liye upyukt hai:

- Jo single premium mein invest karna chahte hain

- Jinko market-linked return chahiye

- Jinko life cover bhi chahiye

- Tax saving bhi chahte hain

Yeh unke liye bhi sahi hai jo mutual fund aur insurance dono ko combine karna chahte hain.

Step 12: Pros and Cons of Nivesh Plus

Pros:

- Single premium payment – no yearly tension

- Market linked returns ka fayda

- Flexibility to switch funds

- Tax benefits

- Death and maturity benefit

Cons:

- Market risk

- No guaranteed return

- High initial charges

Final Verdict from LIC Future:

LIC Nivesh Plus Policy un investors ke liye perfect hai jo long-term ke liye invest karna chahte hain aur sath hi life insurance ka protection bhi chahte hain. Policy mein transparency hai, flexibility hai aur LIC ke trust ke sath aati hai.

Agar aap Bharatpur ya surrounding areas mein hain aur is policy ke baare mein aur jaankari chahte hain, toh aap LIC Future se contact kar sakte hain:

📞 Abhishek Singhal (LIC Agent)

🌐 www.licfuture.com

📱 7231814845

FAQs (Frequently Asked Questions)

Q1: LIC Nivesh Plus mein return fixed hota hai kya?

Ans: Nahi, yeh ULIP plan hai jiska return market par depend karta hai.

Q2: Isme fund change kaise kar sakte hain?

Ans: Aap har saal 4 baar fund switch kar sakte hain without charge.

Q3: Kya policy ko online kharid sakte hain?

Ans: Haan, aap LIC ki website ya LIC Future ke through apply kar sakte hain.

Q4: LIC Nivesh Plus aur mutual funds mein kya farq hai?

Ans: Mutual funds mein life cover nahi hota, jabki Nivesh Plus mein insurance bhi hota hai.

Q5: Policy surrender karne par kya milega?

Ans: Surrender value milti hai jo fund value par depend karti hai aur charges deduct hone ke baad bachi rakam hoti hai.

Conclusion:

LIC Nivesh Plus Policy ek smart choice hai agar aap ek baar mein investment karna chahte hain jisme life cover aur market-linked return dono mile. Is blog ke madhyam se LIC Future ne aapko ek detailed step-by-step guide di hai jisse aap informed decision le sakte hain.

Agar aap is policy mein invest karne ka soch rahe hain, toh bina kisi deri ke contact karein – LIC Future ke LIC Advisor Abhishek Singhal ko!