LIC Nivesh Plus (849) Plan Details: Secure Your Future with LIC Future

In today’s fast-paced world, financial security is paramount. LIC’s Nivesh Plus (849) plan is designed to provide a perfect blend of insurance and investment. At licfuture.com, we bring you a comprehensive guide to understand this unique plan and how it can benefit you.

What is LIC Nivesh Plus (849) Plan?

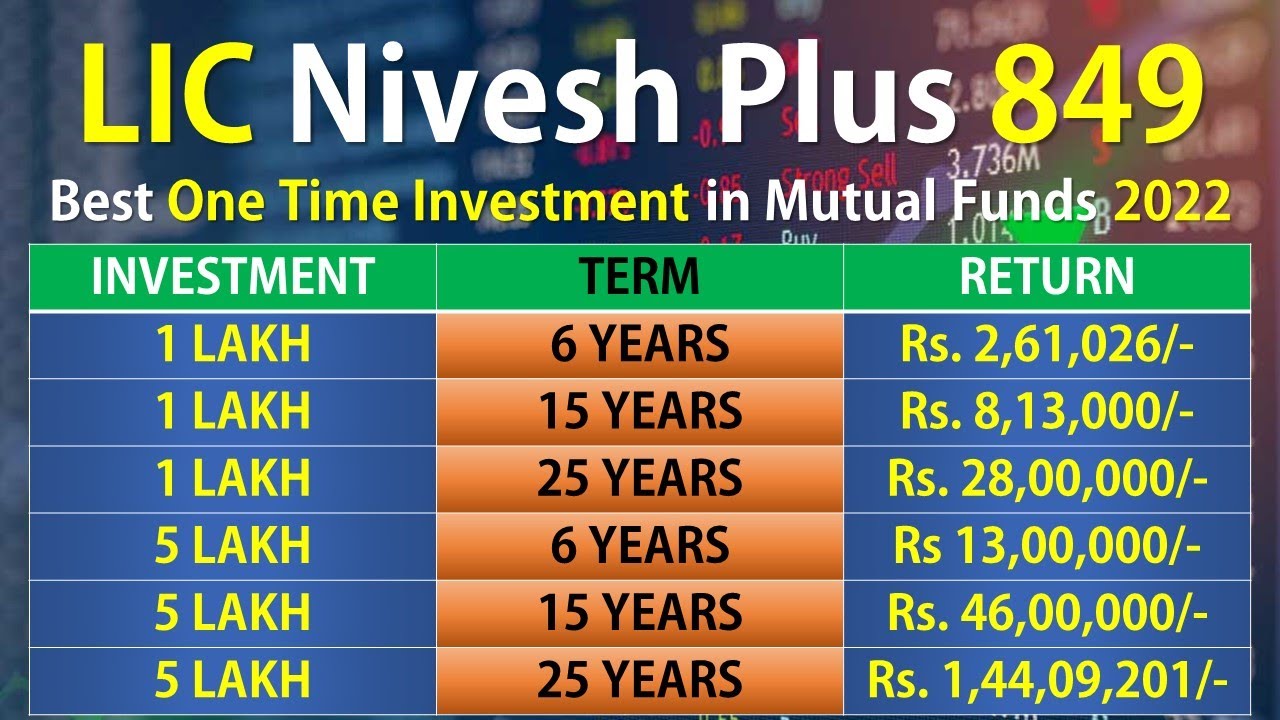

LIC Nivesh Plus (849) is a single premium, unit-linked, non-participating life insurance plan that offers both insurance and investment under a single integrated plan. This plan ensures that your investment grows over time while providing life cover to secure your loved ones’ future.

Key Features of LIC Nivesh Plus (849)

- Single Premium Payment: Pay the premium once and enjoy the benefits throughout the policy term.

- Investment Flexibility: Choose from four different fund options based on your risk appetite:

- Bond Fund

- Secured Fund

- Balanced Fund

- Growth Fund

- Partial Withdrawals: Make partial withdrawals after five policy years to meet financial needs.

- Death Benefit Options: Choose between two death benefit options:

- Option 1: Sum Assured + Fund Value

- Option 2: Higher of Sum Assured or 105% of Single Premium + Fund Value

- Maturity Benefit: Receive the fund value on maturity, ensuring a substantial corpus.

- Switching Option: Switch between funds to maximize returns as per market conditions.

Benefits of LIC Nivesh Plus (849)

- Life Cover: Provides financial security to your family in case of an unfortunate event.

- Wealth Creation: Invest in a fund of your choice to grow your money over the policy term.

- Tax Benefits: Enjoy tax benefits under Section 80C and Section 10(10D) of the Income Tax Act.

- Liquidity: Partial withdrawals offer liquidity to meet emergency needs.

Eligibility Criteria

- Entry Age: 90 days to 70 years

- Policy Term: 10 to 25 years

- Minimum Single Premium: INR 1,00,000

How to Apply for LIC Nivesh Plus (849)?

Applying for the LIC Nivesh Plus (849) plan is simple. Visit licfuture.com and follow these steps:

- Contact Us: Reach out to our expert LIC agents for personalized assistance. 7231814845

- Choose Your Plan: Select the premium amount and policy term that suits your financial goals.

- Submit Documents: Provide the necessary documents for KYC and medical examination, if required.

- Make Payment: Pay the single premium and receive your policy documents.

Why Choose LIC Nivesh Plus (849) through LIC Future?

At licfuture.com, we are committed to helping you make informed financial decisions. Here’s why you should choose us:

- Expert Guidance: Our experienced LIC agents provide personalized advice.

- Hassle-free Process: Smooth and transparent application process.

- Customer Support: Dedicated support team to assist you at every step.

Secure your future today with LIC Nivesh Plus (849) and ensure financial stability for your loved ones. Visit licfuture.com for more information and start your journey towards a secure financial future.

Frequently Asked Questions (FAQs) about LIC Nivesh Plus (849) Plan

Q1: What is the LIC Nivesh Plus (849) plan? A: The LIC Nivesh Plus (849) plan is a single premium, unit-linked, non-participating life insurance policy that combines insurance and investment. It provides life cover and the opportunity to grow your money through various fund options.

Q2: What are the key features of the LIC Nivesh Plus (849) plan?

A: Key features include single premium payment, investment flexibility with four fund options, partial withdrawals after five years, two death benefit options, maturity benefits, and fund switching options.

Q3: What are the fund options available under the LIC Nivesh Plus (849) plan?

A: The plan offers four fund options: Bond Fund, Secured Fund, Balanced Fund, and Growth Fund. Each fund has a different risk and return profile to suit various investor preferences.

Q4: Can I make partial withdrawals from my LIC Nivesh Plus (849) policy?

A: Yes, partial withdrawals are allowed after five policy years. This feature provides liquidity to meet emergency financial needs.

Q5: What are the death benefit options under this plan?

A: There are two death benefit options:

- Option 1: Sum Assured + Fund Value

- Option 2: Higher of Sum Assured or 105% of Single Premium + Fund Value

Q6: What are the tax benefits of the LIC Nivesh Plus (849) plan?

A: You can avail tax benefits under Section 80C for the premium paid and under Section 10(10D) for the maturity proceeds, subject to prevailing tax laws.

Q7: What is the eligibility criteria for the LIC Nivesh Plus (849) plan?

A: The plan is available for individuals aged between 90 days and 70 years. The policy term ranges from 10 to 25 years, with a minimum single premium of INR 1,00,000.

Q8: How can I apply for the LIC Nivesh Plus (849) plan?

A: To apply, visit licfuture.com and contact our expert LIC agents for personalized assistance. Choose your plan, submit the necessary documents, make the payment, and receive your policy documents.

Q9: Why should I choose LIC Nivesh Plus (849) through LIC Future?

A: At licfuture.com, we offer expert guidance, a hassle-free application process, and dedicated customer support to help you make informed financial decisions and secure your future.

Q10: Can I switch between funds in the LIC Nivesh Plus (849) plan?

A: Yes, you have the option to switch between funds to maximize returns based on market conditions and your investment strategy.