LIC Jeevan Umang (Plan No. 945): LIC Future

LIC Jeevan Umang (Plan No. 945) is a unique insurance plan offered by the Life Insurance Corporation of India (LIC) that combines the benefits of income and insurance protection. This plan is an ideal choice for individuals looking for a secure and assured income stream along with life cover. Here’s a detailed overview of LIC Jeevan Umang:

Key Features of LIC Jeevan Umang

- Lifetime Income Benefit: After the completion of the premium payment term, the policyholder receives an annual survival benefit of 8% of the Basic Sum Assured until the age of 100 years.

- Comprehensive Life Cover: In case of the unfortunate demise of the policyholder during the policy term, the nominee receives the Sum Assured along with bonuses.

- Maturity Benefit: Upon survival till the end of the policy term, the policyholder receives the Basic Sum Assured along with accrued bonuses.

- Flexible Premium Payment Terms: The policy offers flexible premium payment terms of 15, 20, 25, or 30 years, making it convenient for different financial plans.

- Loan Facility: The policyholder can avail of a loan against the policy after paying premiums for a specific period.

- Tax Benefits: Premiums paid under this policy are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. The maturity and death benefits are also tax-free under Section 10(10D).

Eligibility Criteria

- Minimum Age at Entry: 90 days

- Maximum Age at Entry: 55 years

- Policy Term: (100 – Age at Entry) years

- Minimum Sum Assured: INR 2,00,000

- Maximum Sum Assured: No limit (subject to underwriting)

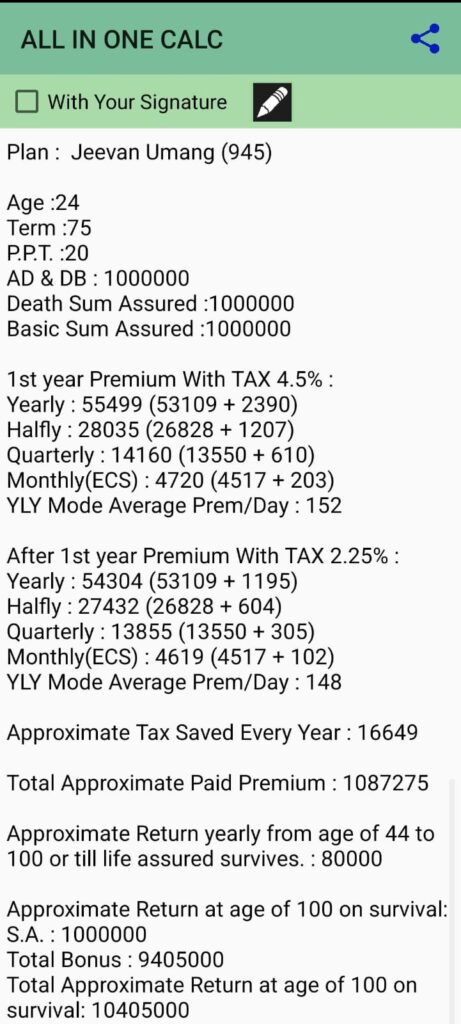

Example Illustration

Consider Mr. Rajesh, a 30-year-old individual who opts for LIC Jeevan Umang with a Sum Assured of INR 5,00,000 and a premium payment term of 20 years. Here’s how the benefits would work for him:

- Annual Premium: Approx. INR 24,000 (excluding taxes)

- Annual Survival Benefit: INR 40,000 from the end of the 20th year until he turns 100 years old.

- Maturity Benefit: Basic Sum Assured of INR 5,00,000 + accrued bonuses at the age of 100.

- Death Benefit: Sum Assured on Death + Bonuses to the nominee in case of Rajesh’s untimely demise during the policy term.

Why Choose LIC Jeevan Umang?

- Guaranteed Income: Secure a steady income stream post-premium payment term.

- Long-Term Protection: Life cover up to the age of 100.

- Financial Security: Ensures your family’s financial stability in your absence.

- Loan Facility: Meet financial emergencies without surrendering the policy.

- Tax Savings: Avail of significant tax benefits under Indian tax laws.

How to Buy LIC Jeevan Umang?

To purchase LIC Jeevan Umang or to get more details, visit our website LIC Future or contact our LIC agent, Abhishek Singhal, at LIC Agency Code: 196 | 14260196. Ensure a secure and prosperous future for you and your loved ones with LIC Jeevan Umang.

Conclusion

LIC Jeevan Umang (Plan No. 945) is a comprehensive plan that offers a blend of income and protection. With its flexible terms, assured returns, and life cover, it stands out as an excellent investment for individuals seeking long-term financial security. Visit LIC Future to learn more and take the first step towards a secure future today!