LIC Jeevan Lakshya Plan 933 Premium Calculator

📌 Want to Secure Your Child’s Future with Smart Planning?

LIC Jeevan Lakshya Plan 933 is one of the most trusted savings + protection plans offered by LIC. But before you invest, it’s important to understand how much premium you’ll pay and what returns you can expect.

In this blog, we’ll walk you through the LIC Jeevan Lakshya Plan 933 Premium Calculator, explain the benefits, and give you real-life examples so you can make the best decision for your family.

🧮 What is LIC Jeevan Lakshya Plan 933?

This is a participating, non-linked, limited premium payment endowment plan. It’s specially designed for those who want to:

- Secure their family’s financial future

- Save systematically for future goals like children’s education or marriage

- Get both death benefit and maturity benefit

🔍 LIC Jeevan Lakshya Plan 933 Premium Calculator – Key Factors

When calculating your premium, the following factors are considered:

| Factor | Details |

|---|---|

| Age of the Policyholder | Minimum: 18 years, Maximum: 50 years |

| Policy Term | 13 to 25 years |

| Premium Payment Term | Policy Term – 3 years |

| Sum Assured | Minimum: ₹1,00,000 (No limit on maximum) |

| Mode of Payment | Monthly, Quarterly, Half-Yearly, Yearly |

| Riders | Optional (Accident, Disability, Critical Illness etc.) |

📊 Real-Life Example Using Premium Calculator

Let’s say Mr. Rahul is 30 years old and wants to take a policy with the following details:

- Sum Assured: ₹5,00,000

- Policy Term: 20 years

- Premium Paying Term: 17 years

- Payment Mode: Yearly

According to the LIC Jeevan Lakshya Plan 933 Premium Calculator (approximate values):

| Yearly Premium | ₹24,400 (excluding taxes) |

|---|---|

| Total Premium Paid in 17 Years | ₹4,14,800 |

| Expected Maturity Amount* | ₹8 to ₹9 Lakhs |

| Death Benefit | Sum Assured + Bonuses + Annual Income Benefit till maturity |

*Maturity value includes bonuses and may vary based on LIC’s declared bonus rates.

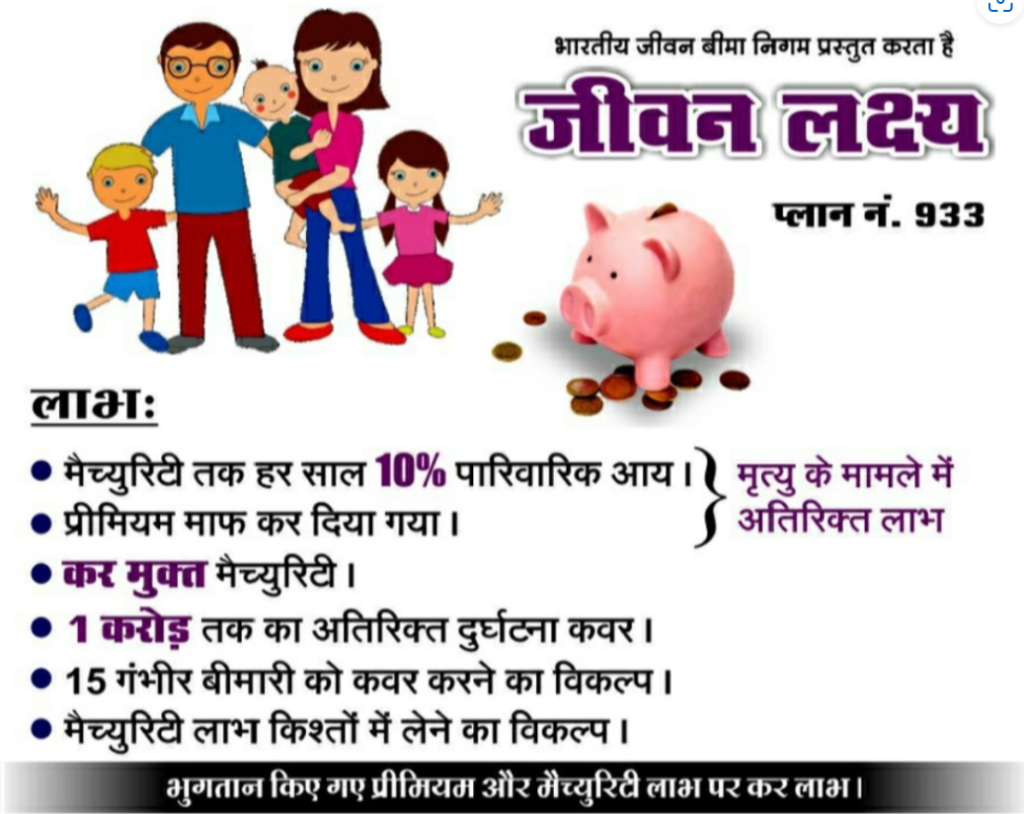

🎁 What You Get – Benefits of the Plan

✅ 1. Death Benefit

In case of unfortunate death during the policy term:

- Annual Income Benefit (10% of Sum Assured every year till maturity)

- Full Sum Assured + Bonuses at maturity

✅ 2. Maturity Benefit

If the policyholder survives the term:

- Sum Assured + Accrued Bonuses + Final Additional Bonus (if declared)

✅ 3. Rider Options

You can enhance your coverage with optional riders:

- Accidental Death & Disability Rider

- New Term Assurance Rider

- Critical Illness Rider

📋 Why Use a Premium Calculator?

Using a premium calculator helps you:

- Know exact premium based on your age and sum assured

- Compare different policy terms easily

- Make a smart decision that suits your budget and goals

Want a personalized premium quote? Fill the form below and our LIC advisor will contact you with the exact calculation.

📞 Get a Free Quote Now!

[📋 Fill the Form to Get LIC Jeevan Lakshya 933 Premium Details]

👉 Name: ___________

👉 Age: ___________

👉 Desired Sum Assured: ___________

👉 Contact Number: ___________

📍 Our expert LIC advisors will contact you shortly with full details, no charges!

📝 Final Thoughts

LIC Jeevan Lakshya Plan 933 is an excellent option for anyone who wants a reliable mix of protection and savings. With the LIC Jeevan Lakshya Plan 933 Premium Calculator, you can easily plan your finances and choose the right sum assured based on your budget.

🔒 Don’t wait for the perfect time – start planning your family’s future today!

For expert help, visit LICFuture.com or get in touch with us now!