Aaj ke samay mein ek surakshit bhavishya ki planning har vyakti ke liye atyavashyak ho gayi hai. LIC (Life Insurance Corporation of India) hamesha se hi bharosemand aur laabhdayak insurance plans prastut karta aaya hai. LIC Bima Bachat 916 ek aisa plan hai jo na sirf aapke aur aapke parivaar ke bhavishya ki suraksha karta hai balki aapko bachat ka bhi laabh pradaan karta hai.

LIC Bima Bachat 916 Kya Hai?

LIC Bima Bachat 916 ek single premium money-back policy hai jo samay-samay par aapko guaranteed returns deti hai. Ye plan un logon ke liye adarsh hai jo ek hi baar premium bharen aur policy ke dauraan paise wapas pane ke saath-saath jeevan beema suraksha bhi chahte hain.

LIC Bima Bachat 916 Ke Features

- Single Premium Payment: Is policy mein aapko sirf ek baar premium jama karna hota hai.

- Guaranteed Money-Back: Policy term ke dauraan kuch anumit samay par aapko certain percentage ke roop mein paise wapas milte hain.

- Maturity Benefits: Policy term pura hone par bima dharak ko maturity amount aur loyalty addition diya jata hai.

- Death Benefit: Agar policyholder ki policy ke dauraan mrityu ho jati hai to naamankit vyakti ko insurance coverage ka poora laabh milta hai.

- Loan Facility: Policy par loan ki suvidha uplabdh hai jo aapke arthik kathinaiyon ke samay kaam aa sakti hai.

- Tax Benefits: LIC Bima Bachat 916 par Income Tax Act ke Section 80C ke tahat chhutt mil sakti hai.

LIC Bima Bachat 916 Kaise Kaam Karta Hai?

- Aap ek baar single premium jama karte hain.

- Aapko policy term ke dauraan fixed intervals par money-back amount milta hai.

- Agar aap policy period tak jeevit rehte hain to aapko maturity benefit aur loyalty additions milta hai.

- Agar policyholder ki mrityu ho jati hai to naamankit vyakti ko poora insurance cover diya jata hai.

LIC Bima Bachat 916 Ke Fayde

- Risk-Free Savings Plan: Bachat aur insurance ka behtareen sangam.

- Fixed Returns: Yojana ke dauraan money-back aur maturity par surakshit rashi milti hai.

- Tax Saving: Is plan ke madhyam se aap apne tax liability ko kam kar sakte hain.

- Liquidity: Policy term ke dauraan hi paisa milne se arthik suvidha bani rehti hai.

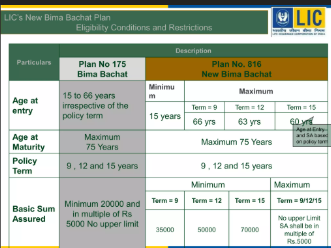

LIC Bima Bachat 916 Ke Liye Eligibility

- Minimum Age: 15 Varsh

- Maximum Age: 66 Varsh

- Policy Term: 9, 12 ya 15 saal

- Minimum Sum Assured: ₹35,000

LIC Bima Bachat 916 Kaise Kharidein?

- LIC Agent: Aap apne nazdeeki LIC agent se sampark kar sakte hain.

- LIC Branch: Kisi bhi LIC shakhah mein jaakar policy apply kar sakte hain.

- Online Apply: LIC ki official website ya kisi vishwasniya financial website ke madhyam se apply kar sakte hain.

Nishkarsh

LIC Bima Bachat 916 un logon ke liye ek behtareen vikalp hai jo ek hi baar premium bhar kar, suraksha aur bachat dono ka laabh uthana chahte hain. Agar aap apne bhavishya ko surakshit banana chahte hain aur risk-free returns chahte hain to ye LIC plan aapke liye ek achha vikalp ho sakta hai.

Agar aapko LIC Bima Bachat 916 ke baare mein aur adhik jaankari chahiye ya ise lene ka vichar kar rahe hain to aaj hi apne nazdeeki LIC visheshagya se sampark karein!