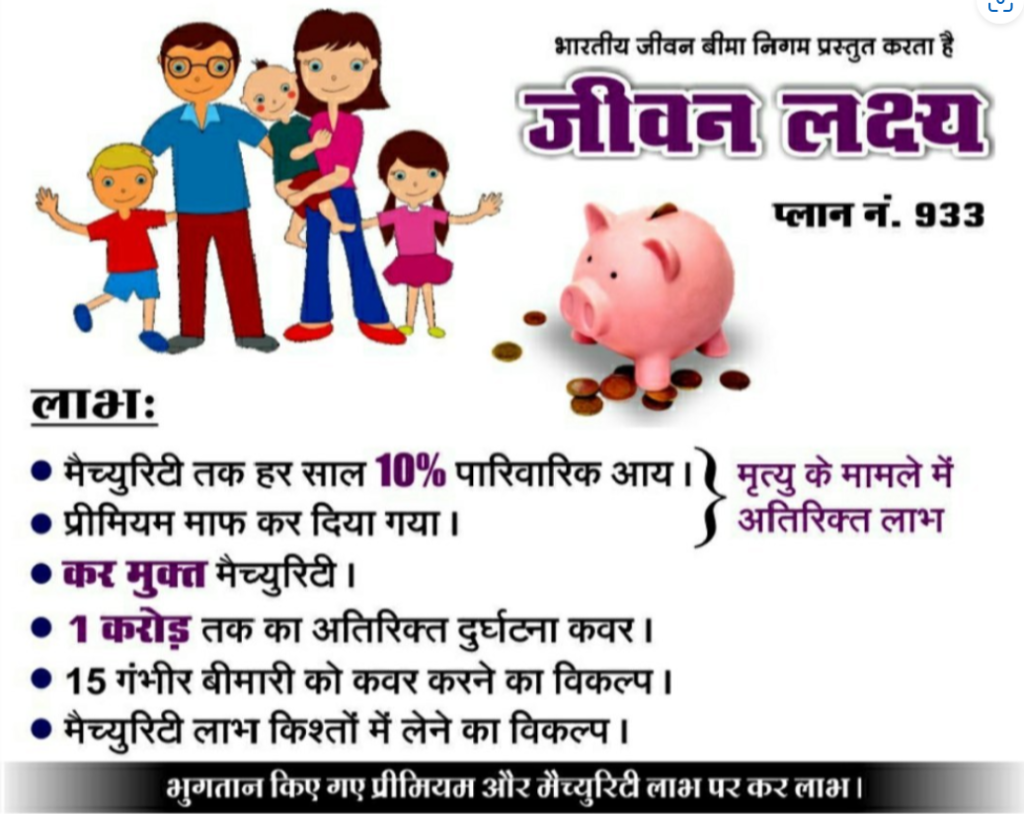

When it comes to securing your family’s financial future, you need a plan that offers more than just insurance. LIC Jeevan Lakshya Plan 933 is designed to do exactly that — it blends life protection, annual income benefits, and maturity savings into one powerful policy.

Let’s understand why LIC 933 Plan is one of the best investment options for responsible parents and future planners.

✅ What is LIC Jeevan Lakshya Plan 933?

LIC Plan 933, also known as Jeevan Lakshya, is a participating, non-linked endowment life insurance plan that provides annual income support to the family in case of the policyholder’s unfortunate demise and a lump sum amount at maturity, regardless of survival.

This plan is ideal for individuals who want to ensure their family, especially children, are financially protected even if they’re not around.

⭐ Key Features of LIC Plan 933

- ✔ Annual Income Support on Death – Ensures family’s monthly needs are met

- ✔ Maturity Benefit – Lump sum payout at the end of policy term

- ✔ Bonus Participation – Earns Simple Reversionary Bonus and Final Additional Bonus

- ✔ Premium Waiver on Death – Remaining premiums are waived off after death

- ✔ Flexible Premium Payment Terms

- ✔ Rider Options – Accidental Death & Disability Benefit Rider, Term Rider, Critical Illness Rider

🎁 Benefits of LIC Jeevan Lakshya Plan 933

🔵 Death Benefit

In case of death of the life assured during the policy term:

- An annual income benefit (10% of Basic Sum Assured) is paid every year till one year before maturity

- Sum Assured on Death + Bonuses is paid at the end of the policy term

- All future premiums are waived

This ensures that your child or nominee receives both regular income and a final maturity amount.

🟢 Maturity Benefit

If the policyholder survives the policy term:

- Basic Sum Assured + Bonuses is paid as a lump sum

📌 Policy Eligibility

| Criteria | Details |

|---|---|

| Minimum Entry Age | 18 years |

| Maximum Entry Age | 50 years |

| Maximum Maturity Age | 65 years |

| Policy Term | 13 to 25 years |

| Premium Paying Term | Policy Term – 3 years |

| Minimum Sum Assured | ₹1,00,000 |

| Maximum Sum Assured | No Limit (in multiples of ₹10,000) |

📊 Example Scenario

Let’s say Mr. Suresh, age 35, takes LIC Plan 933 for 20 years with a Sum Assured of ₹5,00,000.

If he passes away in the 5th year:

- His family will get ₹50,000 every year (10% of ₹5L) from year 6 to year 19

- At maturity (20th year), they’ll receive:

- ₹5,00,000 (Sum Assured)

- Plus accumulated bonuses

- No future premium will be required after death

If he survives:

- He’ll receive ₹5,00,000 + bonuses at maturity

👤 Who Should Buy LIC Jeevan Lakshya Plan?

- Parents planning for child’s education or future needs

- Breadwinners who want to provide financial protection to family

- Investors looking for a mix of protection + savings

- Individuals seeking tax-saving investment with life cover

📞 How to Buy LIC Plan 933?

Getting started is simple!

- 🖱️ Visit LICFuture.com

- 📝 Fill out the enquiry form with basic details

- 📲 Our LIC expert will contact you with personalized advice

- ✅ Submit documents & start your policy

👉 Click Here to Get a Free Quote Now

(Insert your actual link here)

🧾 Tax Benefits

- Premium paid is eligible for deduction under Section 80C

- Maturity/death benefits are tax-free under Section 10(10D)

📣 Why Buy From LICFuture?

- ✅ Trusted LIC Agent Support

- ✅ End-to-End Assistance

- ✅ Fast & Paperless Process

- ✅ Personalized Financial Planning

🔍 Keyphrases to Target

pgsqlCopyEditLIC Jeevan Lakshya Plan 933, LIC 933 Plan, LIC Plan with Annual Income, LIC Plan for Child Future, LIC Endowment Plan, LIC Life Insurance with Maturity Benefit, LIC Savings and Protection Plan, Best LIC Policy for Family, LIC Plan 933 Features, LIC Jeevan Lakshya Benefits, LIC 933 Maturity and Death Benefits

🏁 Conclusion

LIC 933 Plan – Jeevan Lakshya is truly a smart investment that protects your loved ones and ensures their dreams are not compromised, no matter what happens. With its unique combination of income support, maturity savings, and premium waiver benefits, it’s more than just a policy — it’s peace of mind.

📞 Still have questions? Let us guide you step-by-step.

Visit LICFuture.com today and speak to a certified LIC advisor!