Jeevan Utsav 871 Plan Details: LIC ke Saath Apna Bhavishya Surakshit Karein

Introduction

LIC (Life Insurance Corporation of India) ke Jeevan Utsav 871 Plan ek aisa unique policy hai jo aapko aur aapke parivaar ko financial suraksha ke saath bachat ka bhi fayda pradan karta hai. Is blog mein hum aapko is plan ke sabhi features, benefits aur eligibility ke baare mein detail mein batayenge.

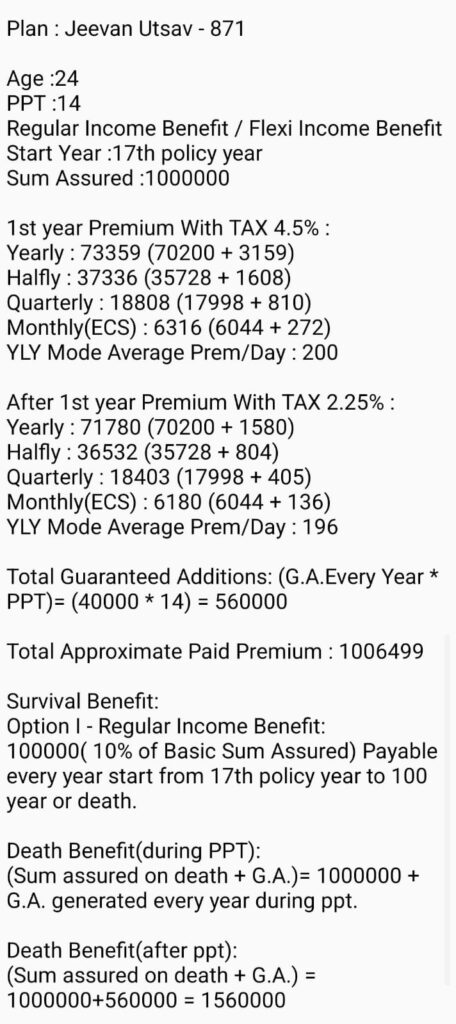

Key Features of Jeevan Utsav 871

- Premium Payment Options:

- Aap apne suvidha ke anusaar monthly, quarterly, half-yearly ya yearly premium bhar sakte hain.

- Is flexible option ke through, aap apne financial planning ko aur aasan bana sakte hain.

- Maturity Benefit:

- Policy ke maturity par, aapko Basic Sum Assured ke saath-saath accrued bonuses bhi milte hain.

- Ye maturity benefit aapki lambi avadhi ki bachat aur investment ka return hai.

- Death Benefit:

- Policyholder ke durbhagyapurna mrityu par nominee ko Sum Assured aur bonuses diye jate hain.

- Ye death benefit aapke parivaar ke financial suraksha ko ensure karta hai jab aap unke saath nahi hote.

- Loan Facility:

- Policyholder apni policy ke against loan bhi le sakta hai agar kuch saalon tak premium regularly bhara gaya ho.

- Ye facility emergency situations mein aapki madad karti hai bina policy ko surrender kiye.

- Tax Benefits:

- Jeevan Utsav 871 plan par aapko Income Tax ke sections 80C aur 10(10D) ke tahat tax benefits milte hain.

- Ye tax benefits aapke overall tax liability ko kam karne mein madad karte hain.

Detailed Benefits of Jeevan Utsav 871

- Security for Family:

- Jeevan Utsav plan ke saath aap apne parivaar ko financial suraksha pradan karte hain.

- Policyholder ki mrityu ke baad bhi parivaar ke kharch aur zaruratein puri hoti hain.

- Savings and Investment:

- Is plan ke madhyam se aap bachat aur nivesh dono kar sakte hain.

- Long-term savings ke saath ye ek assured return ka plan hai.

- Loan Facility:

- Emergency situation mein aap apni policy par loan le sakte hain.

- Policy par loan lena bahut hi aasaan aur kam interest rate par hota hai.

- Tax Benefits:

- Premium payment aur maturity/death benefit par aapko tax mein chhut milti hai.

- Section 80C ke tahat premium payments tax deductible hote hain aur Section 10(10D) ke tahat maturity proceeds tax-free hoti hain.

Eligibility Criteria

- Entry Age:

- Minimum: 18 saal

- Maximum: 50 saal

- Policy Term:

- Minimum: 10 saal

- Maximum: 25 saal

- Sum Assured:

- Minimum Sum Assured: ₹1 lakh

- Maximum Sum Assured: Koi upper limit nahi hai, aap apni zaruratein aur budget ke anusaar choose kar sakte hain.

How to Apply for Jeevan Utsav 871

LIC ke Jeevan Utsav 871 plan ke liye apply karna bahut hi aasaan hai. Aap apne nearest LIC branch mein jaakar ya LIC agent ke madhyam se is plan ko le sakte hain. LIC ki official website par bhi aap is plan ke baare mein aur detail pa sakte hain.

Step-by-Step Application Process:

- Contact a LIC Agent or Visit a Branch:

- Sabse pehle aap apne nearest LIC branch ya kisi authorized LIC agent se sampark karein.

- Provide Necessary Documents:

- KYC documents (ID proof, address proof, photograph)

- Age proof

- Income proof (if required)

- Fill the Application Form:

- Application form ko dhyan se bharein aur saare required fields ko complete karein.

- Choose the Premium Payment Mode:

- Aap monthly, quarterly, half-yearly ya yearly premium payment mode choose kar sakte hain.

- Submit the Form and Documents:

- Complete application form aur required documents ko LIC branch ya agent ke pass submit karein.

- Medical Examination (if required):

- Kuch cases mein medical examination ki zarurat hoti hai jo LIC approved medical centers par kiya jata hai.

- Pay the Initial Premium:

- Initial premium payment karein aur policy issuance ka wait karein.

Conclusion

Jeevan Utsav 871 plan aapko financial suraksha aur bachat dono pradan karta hai. Is plan ke sabhi features aur benefits ko dhyan mein rakhte hue, ye ek achha vikalp hai apne aur apne parivaar ke bhavishya ko surakshit karne ke liye. Agar aapko is plan ke baare mein aur jaankari chahiye toh aaj hi humse sampark karein. 7231814845

Frequently Asked Questions (FAQs)

Q1. Jeevan Utsav 871 plan ke premium payment options kya hain? A1. Aap monthly, quarterly, half-yearly aur yearly basis par premium bhar sakte hain.

Q2. Kya Jeevan Utsav 871 plan par loan facility available hai? A2. Haan, kuch saalon tak premium bhare jaane ke baad aap apni policy par loan le sakte hain.

Q3. Kya is plan par tax benefits milte hain? A3. Haan, aapko is plan par Income Tax ke sections 80C aur 10(10D) ke tahat tax benefits milte hain.

Q4. Jeevan Utsav 871 plan ka entry age kya hai? A4. Entry age minimum 18 saal aur maximum 50 saal hai.

Q5. Policy term kya hai Jeevan Utsav 871 plan ka? A5. Policy term minimum 10 saal aur maximum 25 saal hai.