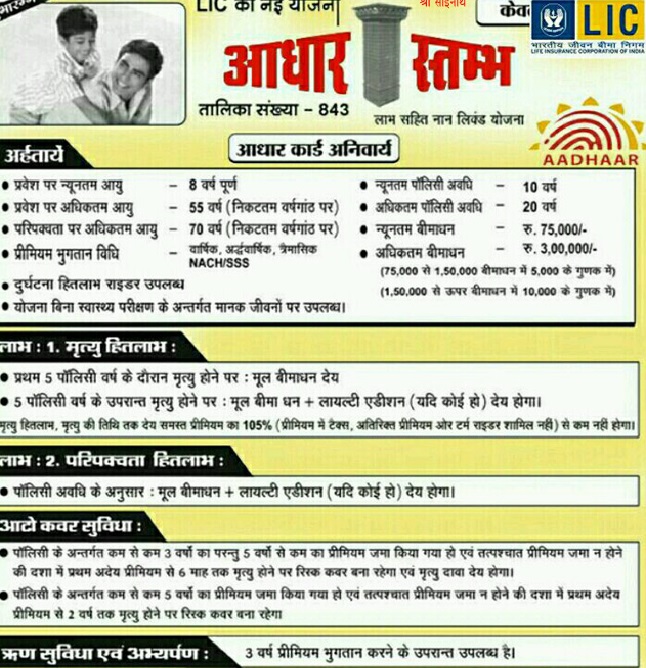

Aadhaar Stambh (Plan No. 943)

Aadhaar Stambh (Plan No. 943) is a non-linked, with-profits, endowment plan offered by LIC. This plan is exclusively designed for male policyholders having an Aadhaar Card issued by UIDAI. It provides a combination of protection and savings, offering financial support for the family in case of the policyholder’s unfortunate demise during the policy term and a lump sum amount at the time of maturity for the surviving policyholder.

Key Features and Benefits of Aadhaar Stambh (Plan No. 943)

- Maturity Benefit:

- On survival to the end of the policy term, Sum Assured on Maturity along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, will be paid.

- Sum Assured on Maturity is equal to the Basic Sum Assured.

- Death Benefit:

- In case of death during the first five policy years:

- “Sum Assured on Death” shall be payable, which is defined as 10 times of annualized premium or Basic Sum Assured, whichever is higher.

- This death benefit shall not be less than 105% of all premiums paid as on date of death.

- In case of death after completion of five policy years but before the maturity date:

- “Sum Assured on Death” shall be payable along with the vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

- This death benefit shall not be less than 105% of all premiums paid as on date of death.

- In case of death during the first five policy years:

- Participation in Profits:

- The policy participates in the corporation’s profits and is eligible for Simple Reversionary Bonuses declared per annum during the policy term, provided the policy is in force.

- Optional Rider:

- Accidental Benefit Rider is available under this plan for a premium payment term of up to 70 years of age.

- Policy Term and Premium Payment Term:

- Policy Term: 10 to 20 years

- Premium Payment Term: Equal to the Policy Term

- Premium Payment Modes:

- Yearly, Half-Yearly, Quarterly, and Monthly (ECS)

- Loan Facility:

- Loan can be availed against the policy, subject to terms and conditions.

- Surrender Value:

- The policy can be surrendered at any time during the policy term provided premiums have been paid for at least three full years. The Guaranteed Surrender Value will be a percentage of total premiums paid.

- Grace Period:

- A grace period of one month but not less than 30 days will be allowed for payment of yearly, half-yearly, or quarterly premiums and 15 days for monthly premiums.

- Revival:

- If the policy has lapsed, it can be revived within a period of 2 consecutive years from the date of the first unpaid premium.

- Free Look Period:

- If the policyholder is not satisfied with the terms and conditions of the policy, they may return the policy to the corporation within 15 days from the date of receipt of the policy document.

Eligibility Criteria

- Minimum Age at Entry: 8 years (completed)

- Maximum Age at Entry: 55 years (nearest birthday)

- Minimum Basic Sum Assured: ₹75,000

- Maximum Basic Sum Assured: ₹3,00,000 (The Basic Sum Assured shall be in multiples of ₹5,000)

- Policy Term: 10 to 20 years

Example

Consider a person aged 30 years opting for a Basic Sum Assured of ₹1,00,000 with a policy term of 15 years. The person would pay premiums for 15 years. If the policyholder survives the policy term, they receive the Basic Sum Assured along with the accrued bonuses. In case of the policyholder’s death during the term, the nominee will receive the death benefit.

For detailed illustrations and premium calculations based on individual requirements, it is advisable to contact an LIC agent or visit the LIC official website.

4o