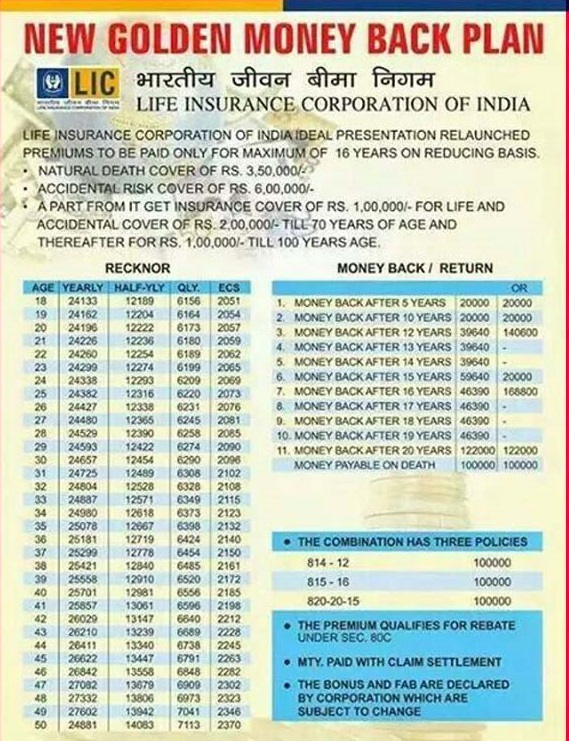

LIC 20 Year Money Back Policy (Plan No. 920)

Plan Type: Non-linked, Participating, Individual, Life Assurance Plan with periodic payments on survival at specific durations during the policy term.

Objective: Provides a combination of protection against death throughout the term of the plan along with periodic payments on survival at specified durations during the policy term.

Key Features:

- Policy Term: 20 years

- Premium Paying Term: 15 years

- Minimum Basic Sum Assured: ₹1,00,000

- Maximum Basic Sum Assured: No Limit (in multiples of ₹5,000)

- Age at Entry:

- Minimum: 13 years (completed)

- Maximum: 50 years (nearest birthday)

- Age at Maturity: Maximum 70 years

Benefits:

- Death Benefit:

- If the policyholder dies during the policy term, the nominee will receive the Death Sum Assured plus vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

- Death Sum Assured is defined as higher of:

- 125% of the Basic Sum Assured.

- 10 times the annualized premium.

- 105% of all premiums paid up to the date of death.

- Survival Benefits:

- On survival at the end of each specified period, the policyholder receives a percentage of the Basic Sum Assured as follows:

- 20% of the Basic Sum Assured at the end of 5th and 10th policy year.

- 20% of the Basic Sum Assured at the end of 15th policy year.

- Remaining 40% of the Basic Sum Assured plus vested Simple Reversionary Bonuses and Final Additional Bonus, if any, at the end of the policy term (20th year).

- On survival at the end of each specified period, the policyholder receives a percentage of the Basic Sum Assured as follows:

- Maturity Benefit:

- On survival to the end of the policy term, the policyholder receives 40% of the Basic Sum Assured plus vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

- Participation in Profits:

- The policy participates in the corporation’s profit and is eligible to receive Simple Reversionary Bonuses declared as per the experience of the corporation.

- Optional Riders:

- LIC’s Accidental Death and Disability Benefit Rider.

- LIC’s New Term Assurance Rider.

- LIC’s Accident Benefit Rider.

- LIC’s New Critical Illness Benefit Rider.

- LIC’s Premium Waiver Benefit Rider.

Rebate:

- Mode Rebate:

- Yearly: 2% of Tabular Premium.

- Half-yearly: 1% of Tabular Premium.

- Quarterly & Monthly: NIL.

- High Sum Assured Rebate:

- ₹1,00,000 to ₹1,95,000: NIL.

- ₹2,00,000 to ₹4,95,000: 2.00% of Basic Sum Assured.

- ₹5,00,000 to ₹9,95,000: 2.50% of Basic Sum Assured.

- ₹10,00,000 and above: 3.00% of Basic Sum Assured.

Grace Period:

- A grace period of 30 days is allowed for payment of yearly, half-yearly, or quarterly premiums. For monthly premiums, the grace period is 15 days.

Revival:

- A lapsed policy can be revived within 5 years from the date of the first unpaid premium by paying all due premiums with interest.

Surrender Value:

- Guaranteed Surrender Value: Available after payment of at least two full years’ premiums.

- Special Surrender Value: Higher of the Guaranteed Surrender Value and Special Surrender Value as applicable at the time of surrender.

Loan Facility:

- Loan can be availed against the policy provided the policy has acquired a Surrender Value.

Exclusions:

- In case of suicide within 12 months from the date of commencement of risk, 80% of the premiums paid will be returned.

- In case of suicide within 12 months from the date of revival, higher of 80% of the premiums paid or acquired Surrender Value will be returned.

How to Apply:

- Interested individuals can visit the official LIC website or contact a LIC agent to apply for the 20 Year Money Back Plan.