Tips for Choosing the Best Retirement Plan

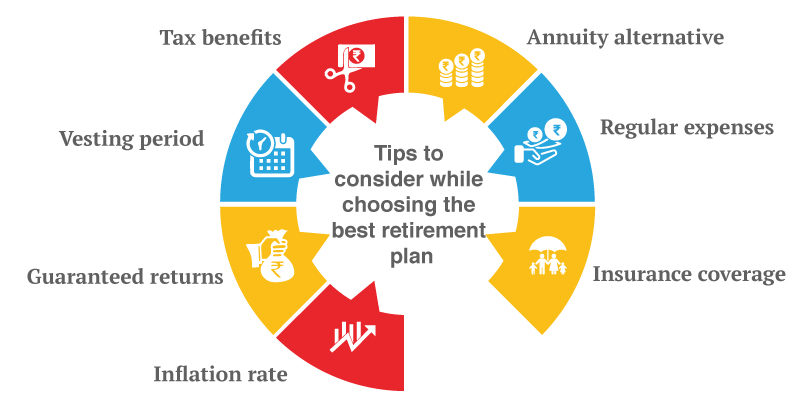

Planning for retirement is a crucial step towards ensuring financial security in your golden years. With so many options available, selecting the right retirement plan can be overwhelming. Here are some tips to help you choose the best retirement plan for your needs:

1. Assess Your Financial Goals

Before selecting a retirement plan, it’s important to clearly define your financial goals. Consider factors such as:

- Desired retirement age

- Expected monthly expenses

- Healthcare costs

- Travel and leisure plans

Understanding your goals will help you determine how much you need to save and the type of plan that suits you best.

2. Understand Different Types of Retirement Plans

There are various types of retirement plans available, each with its own benefits. Some common options include:

- Pension Plans: Provide a fixed monthly income after retirement.

- National Pension System (NPS): A government-sponsored scheme offering both equity and debt investment options.

- Public Provident Fund (PPF): A long-term savings scheme with tax benefits.

- Unit Linked Insurance Plans (ULIPs): Combine insurance and investment.

3. Evaluate the Risk and Return

Different retirement plans come with varying levels of risk and return. It’s essential to evaluate your risk tolerance and choose a plan accordingly. Younger investors might opt for higher-risk, higher-return plans like equity-based ULIPs, while older investors might prefer low-risk options like PPF.

4. Consider Tax Benefits

Many retirement plans offer tax benefits under Section 80C and 10(10D) of the Income Tax Act. Evaluating the tax implications of different plans can help you save money and maximize your retirement corpus.

5. Check the Lock-In Period

Retirement plans often come with a lock-in period during which you cannot withdraw your money. Ensure the lock-in period aligns with your financial goals and liquidity needs.

6. Analyze the Fees and Charges

Be aware of any fees and charges associated with the retirement plan, such as management fees, administrative fees, and fund switching charges. Lower fees mean more of your money is working for you.

7. Review the Plan’s Performance

Check the historical performance of the retirement plan, especially for plans linked to market returns like ULIPs and NPS. Consistent performance over the years indicates reliability.

8. Flexibility and Features

Look for plans that offer flexibility in terms of premium payments, fund options, and partial withdrawals. Features like life cover, accidental death benefits, and maturity benefits can add value to the plan.

9. Seek Professional Advice

Consulting a financial advisor can provide personalized insights based on your financial situation and goals. They can help you navigate the complexities of retirement planning and choose the best plan for you.

10. Start Early

The earlier you start saving for retirement, the more you benefit from the power of compounding. Starting early allows you to build a substantial corpus with smaller, regular investments.

Choosing the right retirement plan is a critical decision that can significantly impact your financial future. By following these tips, you can make an informed choice and secure your retirement years. For more personalized advice and detailed information about LIC retirement plans, visit LIC Future.

Tips for Choosing the Best Retirement Plan: Q&A

Planning for retirement is essential for ensuring financial security in your later years. Here are some commonly asked questions and their answers to help you choose the best retirement plan.

Q1: Why is it important to have a retirement plan?

A: A retirement plan ensures that you have a steady income post-retirement, helping you maintain your lifestyle and cover essential expenses such as healthcare, travel, and daily living costs. It provides financial independence and peace of mind during your golden years.

Q2: What factors should I consider before choosing a retirement plan?

A: Consider the following factors:

- Your financial goals and retirement age

- Expected monthly expenses and lifestyle

- Healthcare costs

- Risk tolerance and investment horizon

- Tax benefits and implications

- Flexibility and features of the plan

Q3: What are the different types of retirement plans available?

A: Common retirement plans include:

- Pension Plans: Provide a fixed monthly income after retirement.

- National Pension System (NPS): A government-sponsored scheme with equity and debt options.

- Public Provident Fund (PPF): A long-term savings scheme with tax benefits.

- Unit Linked Insurance Plans (ULIPs): Combine insurance and investment components.

Q4: How do I assess my risk tolerance?

A: Risk tolerance depends on your age, financial goals, and investment horizon. Younger individuals can afford to take higher risks with equity-based plans, while those closer to retirement might prefer low-risk options like PPF or fixed deposits.

Q5: What tax benefits can I expect from retirement plans?

A: Many retirement plans offer tax benefits under Section 80C and 10(10D) of the Income Tax Act. These benefits can help you save on taxes while growing your retirement corpus.

Q6: What is the importance of the lock-in period in retirement plans?

A: The lock-in period is the duration during which you cannot withdraw your funds. It ensures disciplined savings for retirement. Choose a plan with a lock-in period that aligns with your financial goals and liquidity needs.

Q7: How do I evaluate the performance of a retirement plan?

A: Review the historical performance, especially for market-linked plans like ULIPs and NPS. Consistent performance over the years indicates reliability and potential for steady returns.

Q8: What fees and charges should I be aware of?

A: Be mindful of management fees, administrative fees, and fund switching charges. Lower fees mean more of your money is working towards your retirement goals.

Q9: Can I seek professional advice for retirement planning?

A: Yes, consulting a financial advisor can provide personalized insights based on your financial situation and goals. They can help you navigate the complexities of retirement planning and choose the best plan for you.

Q10: When should I start planning for retirement?

A: The earlier you start, the better. Starting early allows you to benefit from the power of compounding, building a substantial corpus with smaller, regular investments over time.