Blog Outline: Ideal Scenarios for Choosing Money Back Plans

1. Introduction

- Brief introduction to money back plans

- Importance of choosing the right insurance plan

- Mention of LIC Future

2. What are Money Back Plans?

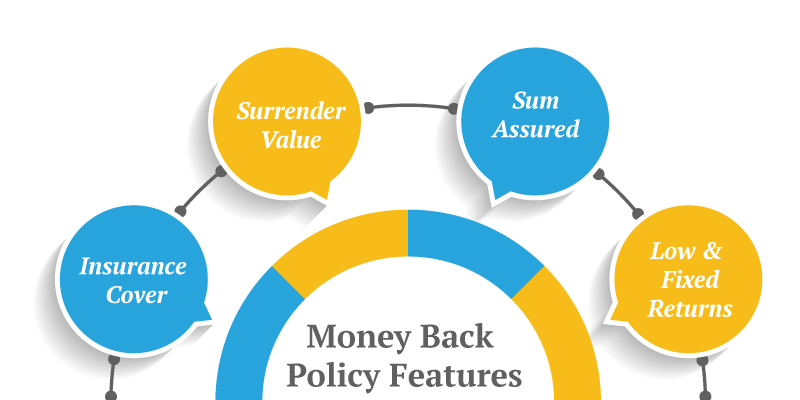

- Definition and features of money back plans

- How they differ from other insurance plans

3. Ideal Scenarios for Choosing Money Back Plans

- For Individuals Seeking Regular Returns:

- Explanation of how money back plans provide periodic payouts

- Example scenarios: planning for children’s education, supplementing regular income

- For Risk-Averse Investors:

- Security and guaranteed returns

- Comparison with other low-risk investment options

- For Long-Term Financial Goals:

- Benefits of combining life cover with savings

- Example scenarios: retirement planning, building a corpus for future needs

- For Those Seeking Liquidity:

- Importance of liquidity in financial planning

- How money back plans provide periodic payouts without waiting till maturity

4. Advantages of Money Back Plans

- Regular income through periodic payouts

- Life cover protection

- Tax benefits

- Flexibility in choosing premium payment terms

5. How to Choose the Right Money Back Plan

- Assessing financial goals and needs

- Understanding the payout structure

- Evaluating the plan’s tenure and premium payment options

- Consulting with a LIC agent

6. Conclusion

- Recap of the benefits and ideal scenarios

- Encouragement to consider money back plans as part of a comprehensive financial plan

- Call to action: Visit LIC Future for more information and consultation

7. Call to Action

- Contact information

- Links to related articles on LIC Future

FAQs: Ideal Scenarios for Choosing Money Back Plans

1. What is a money back plan?

A money back plan is a type of life insurance policy that provides periodic payouts to the policyholder during the policy term, along with a lump sum amount at maturity. These plans offer both insurance coverage and savings benefits.

2. Who should consider a money back plan?

Money back plans are ideal for individuals seeking regular returns, those who are risk-averse, people planning for long-term financial goals, and those needing liquidity during the policy term.

3. How do money back plans provide regular income?

Money back plans provide periodic payouts at specific intervals during the policy term. These payouts can be used to meet various financial needs, such as children’s education, household expenses, or any other planned expenditures.

4. Are money back plans suitable for risk-averse investors?

Yes, money back plans are suitable for risk-averse investors as they offer guaranteed returns along with life insurance coverage. The periodic payouts and the maturity amount provide financial security and stability.

5. Can money back plans help in long-term financial planning?

Absolutely. Money back plans combine life cover with savings, making them an excellent choice for long-term financial goals such as retirement planning or building a corpus for future needs.

6. What are the tax benefits of money back plans?

Money back plans offer tax benefits under Section 80C of the Income Tax Act for the premiums paid, and the payouts received are also tax-free under Section 10(10D), subject to certain conditions.

7. How do I choose the right money back plan?

To choose the right money back plan, assess your financial goals, understand the payout structure, evaluate the plan’s tenure and premium payment options, and consult with a LIC agent for personalized advice.

8. What is the difference between a money back plan and a traditional endowment plan?

While both plans offer life insurance coverage and savings, a money back plan provides periodic payouts during the policy term, whereas a traditional endowment plan only provides a lump sum amount at maturity.

9. Can I get a loan against my money back plan?

Yes, many money back plans offer the option to avail of a loan against the policy, providing additional financial flexibility in times of need.

10. Where can I get more information about money back plans?

For more information about money back plans, visit LIC Future or contact a LIC agent who can guide you through the available options and help you choose the best plan for your needs.