LIC India ULIP & NAV Plans – Buy Plan at Lowest Premiums

Introduction

Financial planning is crucial in today’s uncertain world. Whether it’s for your child’s education, your retirement, or simply to secure your family’s future, making the right investment choices is essential. LIC India ULIP (Unit Linked Insurance Plans) and NAV (Net Asset Value) plans offer a comprehensive solution that combines the benefits of insurance and investment. At licfuture.com, we are dedicated to helping you find the best LIC plans at the lowest premiums.

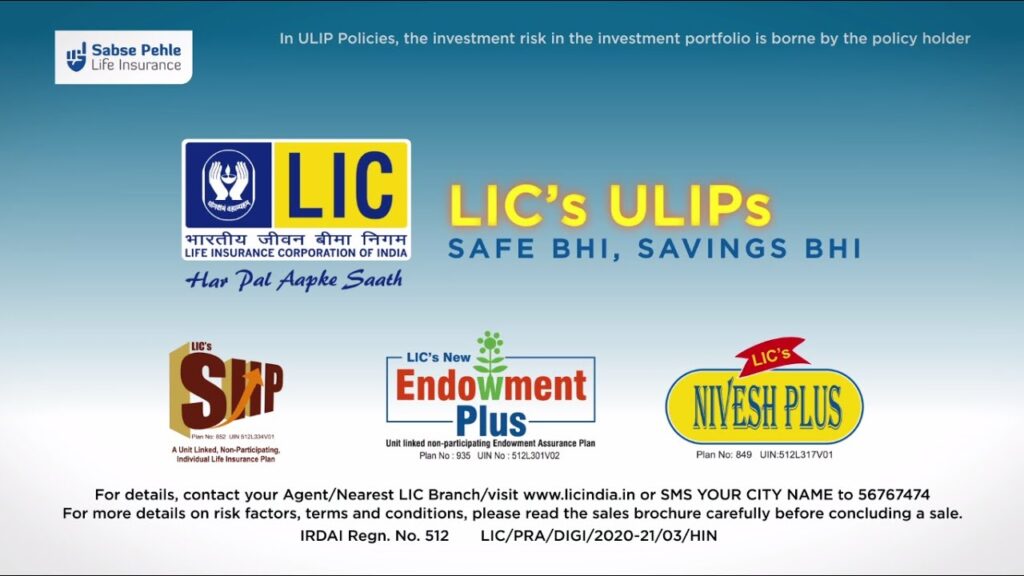

What are ULIP Plans?

Unit Linked Insurance Plans (ULIPs) are a unique blend of investment and insurance. They allow policyholders to enjoy life insurance coverage while simultaneously investing in market-linked assets. This dual benefit ensures that your loved ones are financially protected while your money grows.

Key Features of ULIP Plans:

- Investment Flexibility: Choose from various fund options such as equity, debt, or balanced funds based on your risk tolerance.

- Life Cover: Provides financial security to your family in case of an unfortunate event.

- Partial Withdrawals: Flexibility to withdraw a part of your investment after a specified period.

- Top-Up Facility: Option to invest additional amounts in your policy to enhance your fund value.

- Switching Funds: Flexibility to switch between different fund options to maximize returns.

Benefits of Investing in ULIP Plans

- Long-Term Wealth Creation: ULIPs are designed to promote long-term savings and wealth accumulation.

- Tax Benefits: Enjoy tax deductions under Section 80C for premiums paid and tax-free maturity benefits under Section 10(10D).

- Market-Linked Returns: Potential to earn higher returns compared to traditional insurance products.

- Transparency: Regular updates on fund performance and NAV, ensuring you are always informed about your investment.

- Goal-Based Savings: Align your investments with specific financial goals such as children’s education, marriage, or retirement.

Understanding NAV

Net Asset Value (NAV) is a critical metric for ULIP investors. It represents the per-unit value of the assets in your ULIP fund. NAV is calculated by dividing the total value of the fund’s assets by the number of outstanding units. Monitoring NAV helps investors keep track of their investment performance and make informed decisions.

How NAV Works:

- Calculation: NAV is calculated at the end of each business day based on the market value of the underlying assets.

- Impact of Market Movements: NAV fluctuates with market movements, reflecting the performance of the investments.

- Importance for Investors: A higher NAV indicates better fund performance, helping investors gauge the growth of their investments.

Why Choose LIC India ULIP & NAV Plans?

LIC (Life Insurance Corporation of India) is synonymous with trust and reliability. Here’s why LIC India ULIP & NAV plans are the right choice for your investment needs:

- Trusted Brand: LIC is one of the most trusted and reputable insurance providers in India, known for its customer-centric approach and financial stability.

- Comprehensive Coverage: ULIPs offer a combination of life insurance and investment, ensuring complete financial protection and growth.

- Diverse Investment Options: Choose from a variety of funds that cater to different risk profiles and investment objectives.

- Affordable Premiums: Competitive premium rates ensure that you get the best value for your money without compromising on benefits.

- Expert Guidance: Access to dedicated customer support and expert guidance to help you make informed investment decisions.

How to Buy LIC ULIP Plans at Lowest Premiums

At licfuture.com, we make it easy for you to find and purchase the best LIC ULIP plans at the lowest premiums. Here’s how you can get started:

- Explore Plans: Visit licfuture.com and browse through our extensive range of ULIP plans. Each plan comes with detailed information to help you understand the benefits and features.

- Compare Options: Use our comparison tools to evaluate different plans based on premiums, benefits, fund performance, and other key factors.

- Consult with Experts: Our team of insurance experts is available to provide personalized advice and answer any questions you may have. We help you choose the plan that best fits your financial goals.

- Easy Application Process: Apply online with a hassle-free process that requires minimal documentation. Our user-friendly interface ensures a smooth experience from start to finish.

- Stay Informed: Receive regular updates on your fund’s performance and NAV, allowing you to track your investment and make necessary adjustments.

Tips for Maximizing Your ULIP Investment

- Understand Your Risk Appetite: Choose funds that align with your risk tolerance. Equity funds offer higher returns but come with higher risk, while debt funds are more stable but offer lower returns.

- Regular Review: Periodically review your investment portfolio and make adjustments based on market conditions and changing financial goals.

- Take Advantage of Top-Ups: Use the top-up facility to invest additional amounts during market dips to maximize returns.

- Long-Term Perspective: Stay invested for the long term to benefit from compounding and market growth.

- Utilize Fund Switching: Take advantage of the flexibility to switch between funds based on market trends and performance.

Conclusion

Investing in LIC India ULIP & NAV Plans through licfuture.com is a strategic move towards achieving financial security and growth. With the right plan, you can enjoy the benefits of life insurance and market-linked returns, all at an affordable premium. Our team at licfuture.com is here to guide you every step of the way, ensuring you make the best investment choices for your future.

For more information, visit licfuture.com or contact our experts for personalized assistance.

Frequently Asked Questions (FAQs)

Q1: What is a Unit Linked Insurance Plan (ULIP)?

A1: A ULIP is a financial product that combines insurance and investment. Part of the premium you pay provides life insurance coverage, while the remaining amount is invested in market-linked instruments like equity, debt, or balanced funds. This dual benefit allows you to grow your wealth while ensuring financial protection for your loved ones.

Q2: What is Net Asset Value (NAV) in ULIP?

A2: NAV represents the per-unit value of the assets in your ULIP fund. It is calculated by dividing the total value of the fund’s assets by the number of outstanding units. NAV helps investors track the performance of their investments and make informed decisions.

Q3: How do I choose the right ULIP plan?

A3: To choose the right ULIP plan, consider your financial goals, risk tolerance, and investment horizon. Compare different plans based on their fund options, past performance, charges, and benefits. Consulting with financial experts at licfuture.com can also help you make an informed decision.

Q4: What are the tax benefits of investing in ULIPs?

A4: ULIP investments offer tax benefits under Section 80C of the Income Tax Act. Premiums paid for ULIP policies are eligible for deductions up to ₹1.5 lakh per year. Additionally, the maturity proceeds are tax-free under Section 10(10D), provided certain conditions are met.

Q5: Can I switch between funds in a ULIP?

A5: Yes, ULIPs offer the flexibility to switch between different fund options based on your changing financial goals and market conditions. This feature allows you to maximize your returns by adapting your investment strategy.

Q6: What is the minimum lock-in period for ULIPs?

A6: ULIPs have a minimum lock-in period of five years. During this period, you cannot withdraw your investment. However, it is advisable to stay invested for the long term to benefit from compounding and market growth.

Q7: How can I buy LIC ULIP plans at the lowest premiums?

A7: To buy LIC ULIP plans at the lowest premiums, visit licfuture.com. Explore our range of ULIP plans, compare different options, and consult with our experts for personalized advice. We offer a hassle-free online application process and regular updates on your fund’s performance.

Q8: Are ULIPs suitable for long-term investment?

A8: Yes, ULIPs are ideal for long-term investment as they offer the potential for higher returns through market-linked investments. Staying invested for the long term allows you to benefit from compounding and market growth, making ULIPs a suitable choice for achieving long-term financial goals.

Q9: What are the charges associated with ULIP plans?

A9: ULIP plans may have various charges, including premium allocation charges, fund management charges, policy administration charges, and mortality charges. It’s essential to understand these charges and how they impact your investment. Detailed information about charges is available on licfuture.com.

Q10: How can I monitor the performance of my ULIP investment?

A10: You can monitor the performance of your ULIP investment by regularly checking the NAV and reviewing the fund’s performance reports. LIC provides periodic updates, and at licfuture.com, we offer tools and resources to help you stay informed about your investment.