How to Claim Benefits from Your LIC Policy

Introduction

LIC (Life Insurance Corporation of India) policies are designed to provide financial security and peace of mind to policyholders and their families. Understanding how to claim the benefits of your LIC policy is crucial for ensuring you get the full advantage of your investment. In this guide, we’ll walk you through the step-by-step process of claiming benefits, whether it’s a maturity claim, a death claim, or a rider claim. For more detailed guidance and support, visit our website licfuture.com.

Types of Claims

- Maturity Claims: When the policy term ends.

- Death Claims: In the unfortunate event of the policyholder’s demise.

- Rider Claims: For additional benefits like accident cover or critical illness.

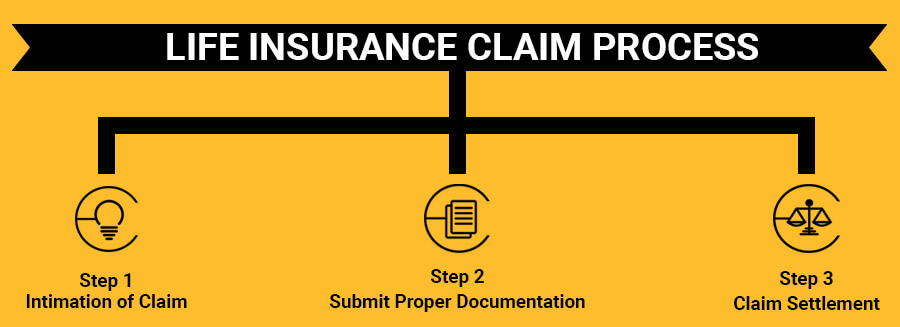

Step-by-Step Process to Claim Benefits

1. Maturity Claims

Maturity claims are the benefits you receive when your policy term ends. Here’s how to proceed:

- Step 1: Receive the Discharge Form

- Description: LIC sends a Discharge Form and Maturity Claim intimation before the policy matures, usually a month in advance.

- Timing: You should receive this form about 2-3 months before the policy maturity date.

- Step 2: Submit Required Documents

- List of Required Documents:

- Original policy document

- Discharge form duly filled and signed

- Proof of identity (Aadhar card, PAN card, etc.)

- Bank account details (Cancelled cheque or bank passbook copy)

- Description: Submit these documents to your nearest LIC branch or through the LIC agent.

- List of Required Documents:

- Step 3: Verification and Settlement

- Explanation: LIC verifies the documents and processes the claim.

- Timeline: The settlement process typically takes 10-15 working days.

2. Death Claims

Death claims are settled in the event of the policyholder’s death. Follow these steps to claim the benefits:

- Step 1: Inform LIC About the Claim

- How: Notify the LIC branch where the policy was serviced or contact your LIC agent.

- When: Immediately after the death of the policyholder.

- Step 2: Submit Claim Form and Documents

- List of Required Documents:

- Death certificate (original or attested copy)

- Original policy document

- Proof of identity of the claimant

- Claimant’s bank account details

- Medical treatment documents (if any)

- How to Submit: Submit these documents to the LIC branch or through your LIC agent.

- List of Required Documents:

- Step 3: Claim Processing

- Explanation: LIC will verify the documents and may conduct an investigation if necessary.

- Timeline: The process usually takes 30-60 days, depending on the complexity of the claim.

3. Rider Claims

Rider claims pertain to additional covers like accident benefits or critical illness cover. Here’s the process:

- Step 1: Notify LIC

- Procedure: Inform LIC about the incident that triggers the rider benefit.

- How: Visit the LIC branch or contact your agent.

- Step 2: Submit Necessary Documents

- Accident Benefit Rider:

- Accident report (FIR or Police report)

- Hospital treatment records

- Disability certificate (if applicable)

- Critical Illness Rider:

- Diagnosis reports

- Medical records

- How to Submit: Hand over these documents to the LIC office or through your agent.

- Accident Benefit Rider:

- Step 3: Claim Settlement

- Description: LIC will review the documents and process the rider claim.

- Timeline: This typically takes 15-30 days.

Common Mistakes to Avoid

- Not keeping the policy document safe: Store it in a secure place.

- Delaying the claim submission: Submit the claim as soon as possible.

- Incomplete or incorrect documents: Ensure all documents are complete and accurate.

Tips for a Smooth Claim Process

- Keep all documents updated and handy: Regularly update your contact details and nominee information.

- Notify LIC promptly: Immediate notification helps in faster processing.

- Regularly check policy status and details: Use the LIC online portal for updates.

Conclusion

Understanding the claims process is essential for leveraging the full benefits of your LIC policy. If you have any doubts or need further assistance, visit licfuture.com for expert guidance and support.

Frequently Asked Questions (FAQs) About Claiming Benefits from LIC Policies

Q1: What is the first step to take when my LIC policy matures?

A1: When your LIC policy matures, LIC will send you a Discharge Form and Maturity Claim intimation a few months before the maturity date. Fill out the Discharge Form and submit it along with the required documents such as the original policy document, proof of identity, and bank account details to your nearest LIC branch or through your LIC agent.

Q2: What documents are needed to file a death claim with LIC?

A2: To file a death claim, you need to submit the following documents:

- Death certificate (original or attested copy)

- Original policy document

- Proof of identity of the claimant

- Claimant’s bank account details

- Medical treatment documents (if any)

Q3: How long does it take for LIC to settle a maturity claim?

A3: The settlement of a maturity claim typically takes about 10-15 working days once all the required documents are submitted and verified by LIC.

Q4: Can I claim benefits from multiple LIC riders at the same time?

A4: Yes, you can claim benefits from multiple riders if the conditions of each rider are met. For example, if you have both an Accident Benefit Rider and a Critical Illness Rider, you can claim for both, provided the necessary conditions and documentation for each are fulfilled.

Q5: What should I do if I lose my original policy document?

A5: If you lose your original policy document, you should immediately inform your LIC branch. You will need to apply for a duplicate policy by submitting an indemnity bond and other required documents. The process may vary, so it’s best to contact your LIC branch for specific instructions.

Q6: How do I notify LIC about a death claim?

A6: To notify LIC about a death claim, you can visit the LIC branch where the policy was serviced or contact your LIC agent. You need to inform them as soon as possible and submit the necessary documents to initiate the claim process.

Q7: Are there any charges for claiming benefits from an LIC policy?

A7: No, there are no charges for claiming benefits from an LIC policy. However, ensure you follow the correct procedure and submit all required documents to avoid any delays.

Q8: Can I track the status of my claim online?

A8: Yes, LIC provides an online portal where you can track the status of your claim. You can log in to the LIC website with your credentials and check the status under the claims section.

Q9: What are the common reasons for claim rejection?

A9: Common reasons for claim rejection include:

- Incomplete or incorrect documentation

- Non-disclosure of material facts at the time of policy purchase

- Policy lapses due to non-payment of premiums

- Claims made within the exclusion period (if applicable)

Q10: How can licfuture.com help me with the claims process?

A10: At licfuture.com, we provide detailed guidance and personalized support to help you navigate the claims process smoothly. Our experts can assist you in preparing the necessary documents, understanding the procedures, and ensuring that your claim is processed without any hassle.

Q11: What is the future of LIC, India?

A11: The future of the Life Insurance Corporation of India (LIC) looks promising, considering several factors that indicate its continued growth and relevance in the Indian insurance sector:

- Market Leadership and Trust: LIC has been a market leader in the Indian life insurance sector for decades. With a vast customer base and a strong brand reputation, LIC continues to enjoy the trust of millions of policyholders. This trust is likely to sustain its leadership position in the future.

- Digital Transformation: LIC is increasingly embracing digital technologies to enhance customer experience, streamline operations, and improve service delivery. With initiatives like online policy purchase, digital premium payments, and mobile apps, LIC is making insurance more accessible and convenient for its customers.

- Product Diversification: LIC has been continuously innovating and diversifying its product portfolio to cater to the evolving needs of its customers. From traditional life insurance policies to modern investment-linked and health insurance plans, LIC offers a wide range of products. This diversification helps in attracting different customer segments and ensures sustained growth.

- Economic Growth and Rising Insurance Awareness: As India’s economy grows and more people become aware of the importance of insurance, the demand for life insurance products is expected to rise. LIC, with its extensive reach and established presence, is well-positioned to capitalize on this growing demand.

- Government Support and Regulatory Framework: Being a government-owned entity, LIC benefits from strong governmental support and a favorable regulatory environment. The Indian government’s focus on financial inclusion and insurance penetration further bolsters LIC’s prospects.

- Expansion and Strategic Partnerships: LIC is exploring opportunities for expansion both within India and internationally. Strategic partnerships and collaborations with other financial institutions and technology firms can open new avenues for growth and innovation.

- IPO and Financial Strength: LIC’s upcoming Initial Public Offering (IPO) is expected to strengthen its financial base and bring in more transparency and efficiency in operations. The IPO will also provide an opportunity for investors to participate in LIC’s growth story, potentially boosting its capital and market valuation.

- Focus on Customer-Centric Services: LIC is increasingly focusing on customer-centric services, improving claims settlement processes, and enhancing overall customer satisfaction. This focus on service quality will help in retaining existing customers and attracting new ones.