How to Choose the Right Term Insurance Plan: A Guide by LIC Future

When it comes to securing the future of your loved ones, term insurance stands out as one of the most cost-effective and reliable options. But with so many plans available, how do you choose the right one? At LIC Future, we believe that making an informed decision is crucial. Here’s a comprehensive guide to help you select the perfect term insurance plan.

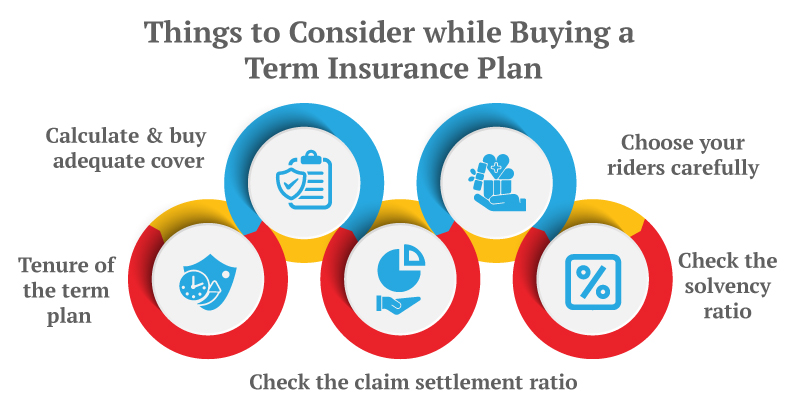

1. Assess Your Coverage Needs

The first step is to determine how much coverage you need. Consider factors such as:

- Outstanding Loans: Ensure your coverage is enough to pay off any debts.

- Family’s Living Expenses: Calculate the amount required to maintain your family’s current lifestyle.

- Future Goals: Include costs for your children’s education, marriage, and other long-term goals.

2. Choose the Right Policy Term

The policy term should align with your financial responsibilities. For instance:

- If you have young children, choose a term that covers them until they become financially independent.

- If you have a mortgage, the term should cover the loan tenure.

3. Compare Premiums

While affordability is important, don’t choose a plan based solely on low premiums. Compare premiums across different insurers but also consider the benefits, features, and claim settlement ratio.

4. Check the Claim Settlement Ratio

The claim settlement ratio indicates the percentage of claims an insurer has settled. A higher ratio means a better chance of your family’s claim being honored. LIC, for example, has a robust claim settlement record, making it a trusted choice.

5. Consider Additional Riders

Enhance your term plan with riders for extra protection. Popular riders include:

- Accidental Death Benefit: Provides additional sum assured in case of accidental death.

- Critical Illness Rider: Offers a lump sum amount on diagnosis of specified critical illnesses.

- Waiver of Premium: Waives off future premiums in case of disability or critical illness.

6. Understand the Exclusions

Every term plan has certain exclusions. Read the policy document carefully to understand what is not covered. This will prevent any surprises at the time of claim.

7. Evaluate the Insurer’s Reputation

Research the insurer’s reputation in terms of customer service, claim settlement process, and overall reliability. LIC, being one of the oldest and most trusted insurance providers in India, has a stellar reputation.

8. Read Reviews and Testimonials

Customer reviews and testimonials can provide valuable insights into the insurer’s service quality and reliability. At LIC Future, we encourage you to read reviews and learn from the experiences of other policyholders.

9. Seek Professional Advice

If you’re unsure, consult a financial advisor. They can provide personalized recommendations based on your financial situation and goals.

Conclusion

Choosing the right term insurance plan is a crucial decision that requires careful consideration of various factors. At LIC Future, we are committed to helping you make an informed choice that ensures the financial security of your loved ones. Visit our website, licfuture.com, for more information and personalized assistance.

Secure your future with the right term insurance plan today! Contact 7231814845

FAQs: Choosing the Right Term Insurance Plan

Q1: What is term insurance?

A1: Term insurance is a type of life insurance that provides coverage for a specified term or period. If the policyholder passes away during the policy term, the nominee receives the death benefit. It offers high coverage at affordable premiums.

Q2: How do I determine the amount of coverage I need?

A2: To determine the coverage amount, consider your outstanding loans, your family’s living expenses, future goals such as your children’s education, and any other financial obligations. A general rule of thumb is to opt for coverage that is 10-15 times your annual income.

Q3: What should I consider when choosing the policy term?

A3: The policy term should match your financial responsibilities. If you have young children, choose a term that covers their growing years until they become financially independent. If you have a mortgage, ensure the term covers the loan tenure.

Q4: Why is the claim settlement ratio important?

A4: The claim settlement ratio indicates the percentage of claims an insurer has successfully settled. A higher ratio suggests a higher likelihood that your family’s claim will be honored without hassle. Always check the claim settlement ratio before choosing an insurer.

Q5: What are riders, and should I consider adding them to my term insurance plan?

A5: Riders are additional benefits that you can add to your base policy for extra protection. Common riders include Accidental Death Benefit, Critical Illness Rider, and Waiver of Premium. Adding riders can enhance your coverage and provide more comprehensive protection.

Q6: What exclusions should I be aware of in a term insurance plan?

A6: Exclusions are situations or conditions not covered by the policy. Common exclusions include death due to self-inflicted injuries, involvement in hazardous activities, and death due to pre-existing medical conditions. Always read the policy document to understand the exclusions.

Q7: How can I compare premiums effectively?

A7: To compare premiums, look at the cost of the policy in relation to the coverage and benefits it offers. Use online comparison tools, read policy documents, and consider the insurer’s reputation and claim settlement ratio. Don’t choose a plan based solely on low premiums; consider the overall value.

Q8: Why should I consider LIC for my term insurance needs?

A8: LIC is one of the most trusted and established insurance providers in India with a strong claim settlement record and a wide range of policies to suit various needs. Their reputation for reliability and customer service makes them a preferred choice for many.

Q9: Can I change my term insurance plan if my needs change?

A9: While you cannot change the term or coverage amount of an existing policy, you can purchase additional coverage or a new policy to meet your changing needs. Some insurers may also allow policy upgrades during certain periods.

Q10: Is professional advice necessary when choosing a term insurance plan?

A10: Professional advice can be very helpful, especially if you are unsure about the amount of coverage you need or the type of riders to add. A financial advisor can provide personalized recommendations based on your financial situation and goals.

For more detailed information and personalized assistance, visit licfuture.com and secure your family’s future with the right term insurance plan today!